My Major Overall health Inventory for 2021

Want to check out guessing the name of my favourite health and fitness inventory for 2021? Below are a several clues. This biotech corporation generates billions in earnings, guarantees management in its key market for at least the coming 15 a long time, and is trading at only about 20 situations forward earnings (in a sector wherever 30 is small to regular). And this past fall, the business lifted its forecast for full-yr 2020 product earnings.

I also like the simple fact that the coronavirus pandemic didn’t interrupt the supply of the company’s medicine to sufferers. This player did effectively in weathering the coronavirus storm very last 12 months, so it should carry out perfectly this year — crisis or not. All set to see if you know which company I am talking about? Properly, then read through on …

Image resource: Getty Photos.

4 cystic fibrosis treatment options

The leading well being inventory I’m betting on this year is Vertex Pharmaceuticals (NASDAQ: VRTX), a biotech with four solutions for cystic fibrosis (CF) on the industry. Vertex is also building therapies for blood diseases, suffering, and a lung and liver problem identified as alpha-1 antitrypsin deficiency (AATD). Let us acquire a glimpse at Vertex’s prospects in the close to phrase and the extensive term.

CF is Vertex’s principal small business. About 75,000 folks globally have this multi-technique genetic disease, which triggers lousy stream of salt and water in and out of organs. In the lungs, sticky mucus builds up, typically top to lung problems and dying.

Prior to the start of its latest CF drug, Trikafta, Vertex presently held 46% of the world market place. The U.S. Food items and Drug Administration accredited Trikafta in Oct 2019, and its profits have been booming, building it very likely that Vertex’s current market share has greater. In the most recent earnings contact, administration explained it expects to hold on to its management in the CF current market right up until at least the late 2030s.

So, what does CF signify in terms of earnings for Vertex? Morningstar predicts the portfolio might crank out a lot more than $10 billion in earnings in 2028. And Vertex is on the suitable keep track of — Trikafta has already come to be a blockbuster, with more than $3 billion in earnings since it hit the sector.

Item revenue is up 62%

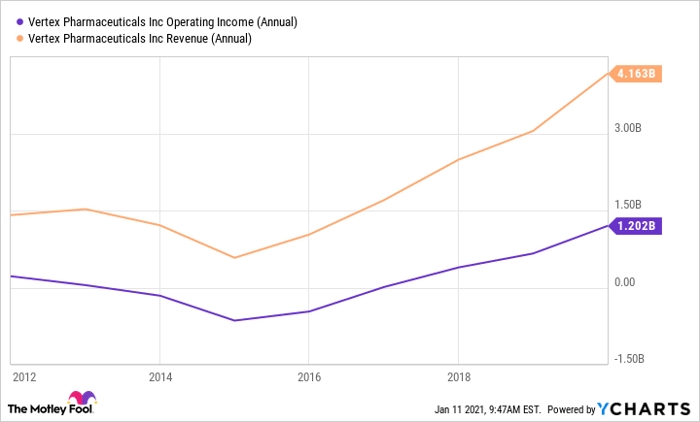

Vertex’s whole product profits in the third quarter advanced 62% to $1.54 billion. And administration lifted complete-calendar year 2020 product or service profits advice to the vary of $6 billion to $6.2 billion, up from a assortment of $5.7 billion to $5.9 billion. Vertex’s annual profits and running revenue have been climbing given that 2015.

VRTX Functioning Profits (Annual) facts by YCharts

In March of previous calendar year, Vertex claimed the coronavirus disaster hadn’t interrupted the Trikafta start or the provide of any of its treatments to sufferers.

Income must go on to climb as Trikafta gains acceptance in expanded affected person groups, dependent on age and genetic mutations, as well as in additional nations. Vertex said Trikafta has the prospective to deal with about 90% of CF clients. Most lately, the Food and drug administration accepted Trikafta and two other Vertex drugs — Symdeko and Kalydeco — for specified exceptional mutations that cause the disease. This implies about 600 further CF people are now qualified for these Vertex treatment options. The once-a-year wholesale price tag for Trikafta in the U.S. is $311,503 for every affected individual.

Looking at all of this, why did Vertex’s shares only rise 7.9% final calendar year? Buyers sanctioned the stock this past tumble just after the organization halted the enhancement of a applicant for AATD, with shares sinking by 26% in a single investing session. Some investors are worried about Vertex’s long term beyond CF. But the failure of sure investigational medication is a ordinary portion of drug development. And Vertex emphasized that shifting several candidates into early clinical trials and then deciding on the strongest is element of its technique. Which is what is going on with AATD. The organization has a second AATD prospect in section 2 scientific studies and expects data in the very first halfof this calendar year. So, in my watch, the failure of one AATD candidate is not a motive for alarm.

Vertex is progressing in other packages, as well. Concerning a collaboration with CRISPR Therapeutics (NASDAQ: CRSP), management mentioned the companies’ gene-editing remedy assisted blood disorder people keep on being totally free of acute agony crises or the need to have for blood transfusions for months soon after treatment method. The period 1/2 scientific studies consist of patients with either sickle mobile illness or beta thalassemia.

In the vicinity of expression and lengthy time period

So, in both of those the in close proximity to phrase and the extended term, we can be expecting income gains from Vertex’s CF system. And in the long time period, the biotech business‘s pipeline packages may well direct to new treatment method areas. At the minute, Vertex has 7 non-CF treatment options in the pipeline. In the meantime, CF management for just about two decades to come seems great to me.

10 stocks we like improved than Vertex Pharmaceuticals

When investing geniuses David and Tom Gardner have a stock suggestion, it can pay back to hear. Immediately after all, the newsletter they have run for around a 10 years, Motley Fool Inventory Advisor, has tripled the current market.*

David and Tom just disclosed what they believe are the 10 ideal shares for traders to invest in correct now… and Vertex Prescribed drugs was not one of them! Which is right — they feel these 10 shares are even greater buys.

*Inventory Advisor returns as of November 20, 2020

Adria Cimino owns shares of Vertex Pharmaceuticals. The Motley Idiot owns shares of and recommends CRISPR Therapeutics. The Motley Idiot suggests Vertex Pharmaceuticals. The Motley Fool has a disclosure plan.

The sights and views expressed herein are the views and views of the writer and do not essentially mirror all those of Nasdaq, Inc.